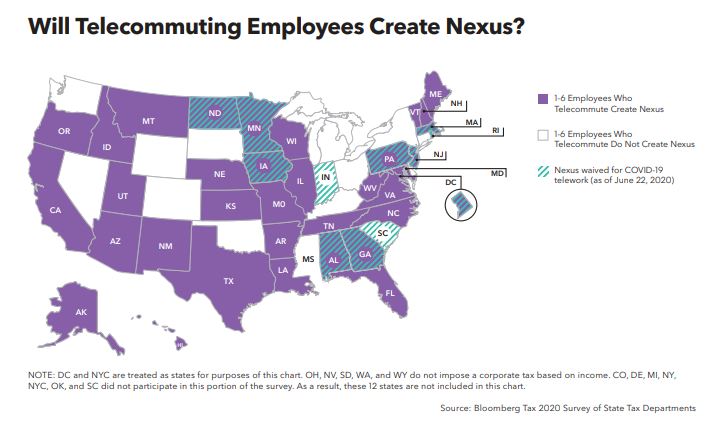

The sudden shift to remote work for many corporations in response to Covid-19 may lead to costly compliance burdens as 36 state tax departments indicate that having just one employee telecommuting from their state will create nexus for corporate income tax.

This is just one of the key findings from the 20th annual Bloomberg Tax & Accounting Survey of State Tax Departments, which incorporates input on income and sales tax issues that matter most to corporations from senior state tax department officials from all 50 states, Washington, D.C., and New York City. An executive summary of the survey is available at http://onb-tax.com/WnbC50AwM3k.

–36 States Indicate That Having Just One Employee Telecommuting From Their State Will Create Nexus–

The 2020 survey focuses on the impact of the Covid-19 pandemic on compliance, nexus issues, state sourcing provisions, the taxation of pass-through entities, the transition to economic nexus, and state tax policy for marketplace facilitators. The survey also explores how states are implementing their economic nexus rules post-South Dakota v. Wayfair, with a focus on economic nexus threshold calculations.

“The 2020 survey sheds light on how state tax departments are responding to the unique challenges posed by the Covid-19 pandemic and provides guidance for corporate tax professionals looking to navigate these murky waters,” said Christine Boeckel, director, state tax analysis and content, Bloomberg Tax & Accounting. “For decades, tax professionals have relied on Bloomberg Tax to help them know, understand, and take decisive action in arenas such as state tax that are fraught with variation, complexity, confusion and ambiguity. This survey is a resource our subscribers turn to for clarity given states’ lack of clear guidance on the types of activities that trigger nexus and taxability.”

“The Bloomberg Tax & Accounting State Tax Survey is indispensable in providing quick state tax guidance,” said Bruce P. Ely, partner, Bradley. “I can almost always find an answer to the question I’m researching and I’ve found the survey to be the most comprehensive, easy-to-search resource of its kind.”

Additional survey findings include:

- Thirty-six states, more than double the number of pre-Wayfair responses in 2018, said they have an economic nexus standard for sales tax nexus.

- Sixteen states said that a third-party vendor is obligated to collect sales tax on delivery or errand services that are arranged by the third-party vendor, such as Postmates, Grub Hub, and Task Rabbit, while only five said this obligation was imposed on the delivery or errand person.

- Twenty-seven states said that marketplace facilitators such as eBay and Etsy are required to collect sales and use tax on sales made via their platforms by marketplace sellers, provided they have nexus with the taxing jurisdiction. Twenty-three of these states said that marketplace sellers are relieved of liability for tax that is supposed to be collected by a marketplace facilitator.

- Thirteen states said they make adjustments, determine imputed tax, and assess and collect tax at the entity level for partnerships, while 25 states said they do so at the owner level. Nine states said they do so at both levels.

Bloomberg Tax & Accounting will also host a webinar, Learning from the 2020 Survey of State Tax Departments – Corporate Income Taxation, on Tuesday, July 28 at 2:00 p.m. ET. This webinar will take a closer look at the recent trends in state corporate income taxation, analyze the survey results in these areas, and provide a discussion on recent changes in states’ taxation of corporations. Register for the webinar at http://onb-tax.com/GJSj50AnVop.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Sales Tax

![telecommuting-map[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/07/telecommuting_map_1_.5f109c6053ecc.png)